Selecting the right payment gateway is a crucial decision for any business that wants to accept online payments. The right gateway can enhance customer experience, ensure secure transactions, and streamline your financial operations. However, with so many options available, it can be challenging to determine which one is best suited for your business needs. This guide will walk you through the key factors to consider, the pros and cons of different gateways, and tips for making an informed decision.

Key Factors to Consider

-1- Security

- Importance: Security is paramount when dealing with financial transactions.

- Considerations: Look for gateways that are PCI DSS compliant and offer fraud detection and prevention tools.

-2- Integration

- Importance: Easy integration with your existing systems can save time and reduce headaches.

- Considerations: Ensure the gateway supports your e-commerce platform, shopping cart, and other tools you use. Check for available APIs and plugins.

-3- Fees and Costs

- Importance: Understanding the fee structure helps in budgeting and cost management.

- Considerations: Compare transaction fees, setup fees, monthly fees, and any hidden charges. Look for gateways that offer transparent pricing.

-4- Supported Payment Methods

- Importance: Offering multiple payment options can improve customer satisfaction and increase sales.

- Considerations: Ensure the gateway supports credit/debit cards, digital wallets, bank transfers, and any other payment methods relevant to your target market.

-5- User Experience

- Importance: A smooth and seamless payment process enhances customer satisfaction and reduces cart abandonment rates.

- Considerations: Evaluate the checkout process, mobile-friendliness, and customization options of the payment gateway.

-6- Customer Support

- Importance: Reliable customer support can resolve issues quickly and minimize downtime.

- Considerations: Look for gateways that offer 24/7 support through various channels like phone, email, and live chat.

-7- Settlement Time

- Importance: Faster settlement times improve cash flow and financial management.

- Considerations: Check the gateway's policy on how quickly funds are transferred to your account after a transaction.

Pros and Cons of Different Payment Gateways

-1- PayPal

- Pros: Widely recognized and trusted, easy to set up, supports multiple currencies.

- Cons: Higher transaction fees, limited customization, funds may be held in disputes.

-2- Stripe

- Pros: Developer-friendly, highly customizable, supports a wide range of payment methods.

- Cons: Requires technical expertise for setup, customer support mainly through email.

-3- Square

- Pros: User-friendly, no monthly fees, integrates well with point-of-sale systems.

- Cons: Limited global reach, higher fees for certain transactions.

-4- Authorize.Net

- Pros: Established reputation, robust fraud protection, extensive support for various payment methods.

- Cons: Monthly fees, setup fees, and complex pricing structure.

-5- Adyen

- Pros: Global reach, supports multiple payment methods and currencies, advanced analytics.

- Cons: Higher setup and transaction fees, more suitable for larger businesses.

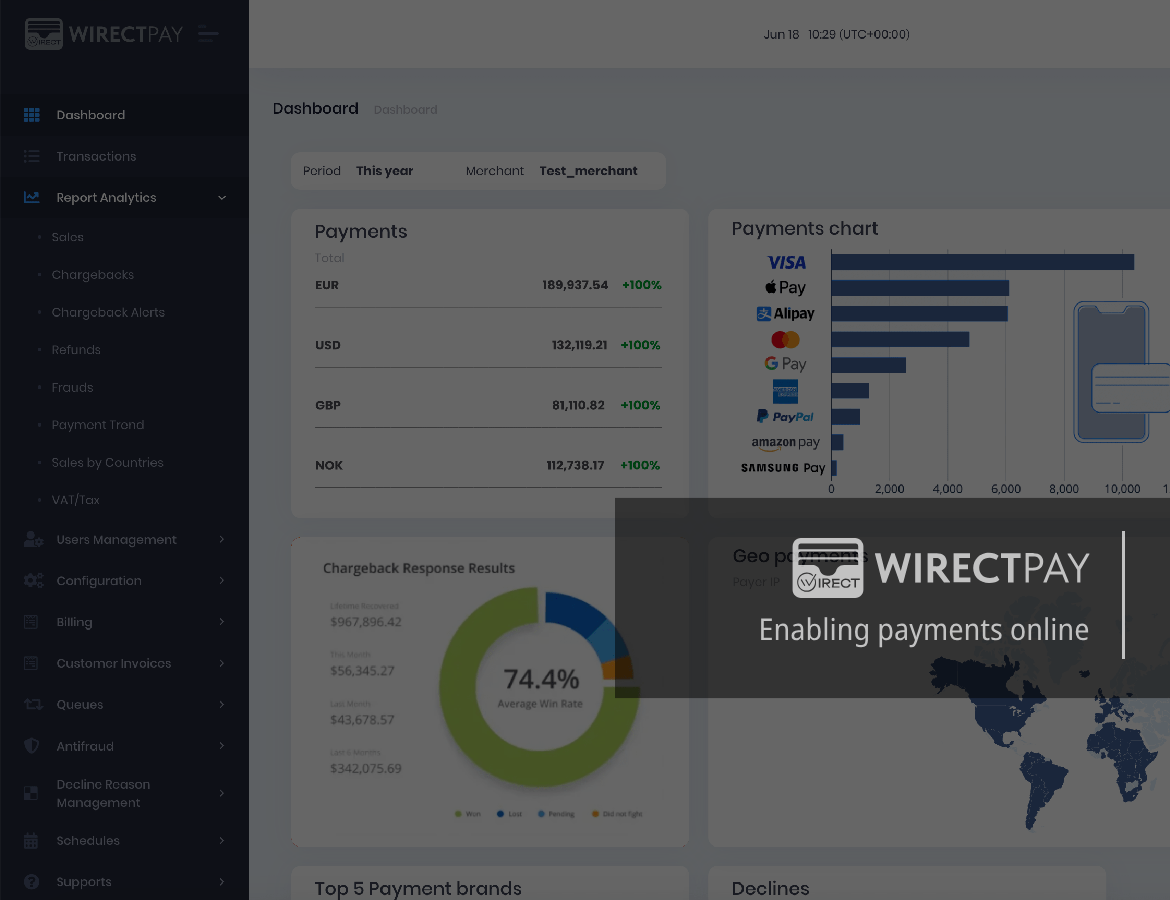

-6- WirectPay

- Pros: Affordable pricing, supports a variety of payment methods, easy integration, strong security and compliance, reliable customer support.

- Cons: Limited global reach in terms of onboarding (EU-based companies only), lower brand recognition.

Tips for Making an Informed Decision

-1- Evaluate Your Business Needs

- Assess your current and future payment processing requirements, including expected transaction volume and types of payments you want to accept.

-2- Compare Multiple Gateways

- Don’t settle on the first gateway you find. Compare at least three to five options based on the factors mentioned above.

-3- Read Reviews and Testimonials

- Look for feedback from other businesses in your industry to understand the strengths and weaknesses of each gateway.

-4- Request Demos and Trials

- Many payment gateways offer demos or trial periods. Take advantage of these to test the user experience and integration process.

-5- Consider Scalability

- Choose a gateway that can grow with your business. Ensure it can handle increased transaction volumes and support additional payment methods as needed.

-6- Check Legal and Compliance Requirements

- Ensure the payment gateway complies with local regulations and industry standards relevant to your business.

Conclusion

Choosing the right payment gateway is essential for the success of your online business. By considering factors such as security, integration, fees, supported payment methods, user experience, customer support, and settlement time, you can make an informed decision that meets your business needs. Evaluate different gateways, compare their pros and cons, and follow our tips to select the best option for your business.

Stay tuned to the WirectPay blog for more insights and updates on the latest trends and innovations in the world of online payments and fintech.